Discover why whisky cask ownership will be your smartest move in 2025.

Use our resources below to learn more about why whisky casks are emerging as a reliable cornerstone in a diversified asset portfolio.

Enter the world of whisky cask ownership

Learn more about purchasing whisky casks in our 30 minute webinar with Speyside Capital’s CEO Paul Kopec.

Stable Returns in Unstable Times: Why Investors Are Turning to Scotch Whisky Casks

In today’s volatile financial landscape, finding a safe and reliable investment can feel like an uphill battle. The good news? Investing in Scotch whisky casks provide a unique opportunity to safeguard your wealth while still achieving impressive returns, typically ranging from 8-15% per annum.

Unlike traditional financial markets, whisky casks are uncorrelated to the stock market, meaning your investment is insulated from the dramatic ups and downs of market and media volatility. Instead of being at the mercy of market sentiment, you can rest easy knowing your money is anchored in a tangible asset that is independent of the daily news cycle or market gyrations.

Why Whisky?

Whisky is the top-performing alternative asset, offering protection against stock market volatility.

- Outperforms property and stocks

- Best alternative asset of the decade

- Exempt from capital gains tax

- 8-15% returns per annum

- Own a tangible asset in your name

- Uncorrelated to stock markets

- Lower risk, stable investment

- Fully securitised ownership

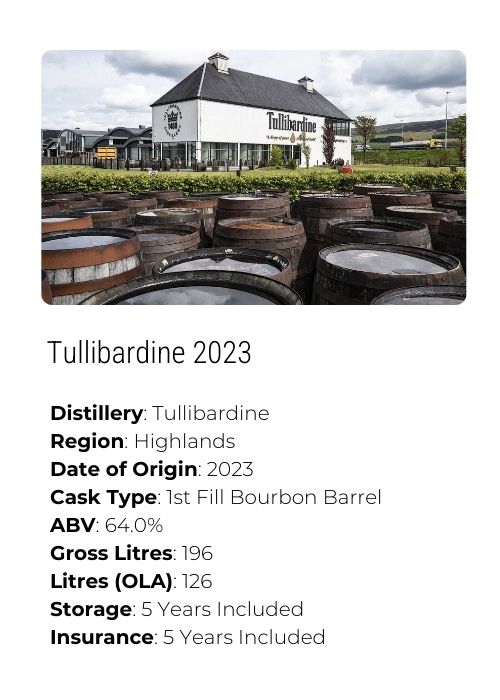

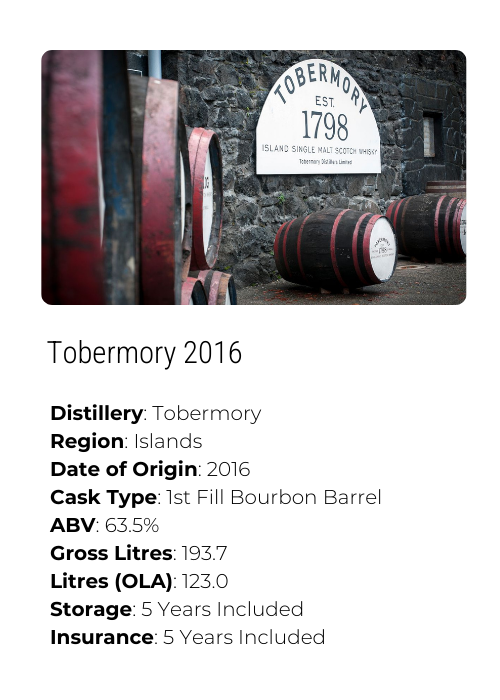

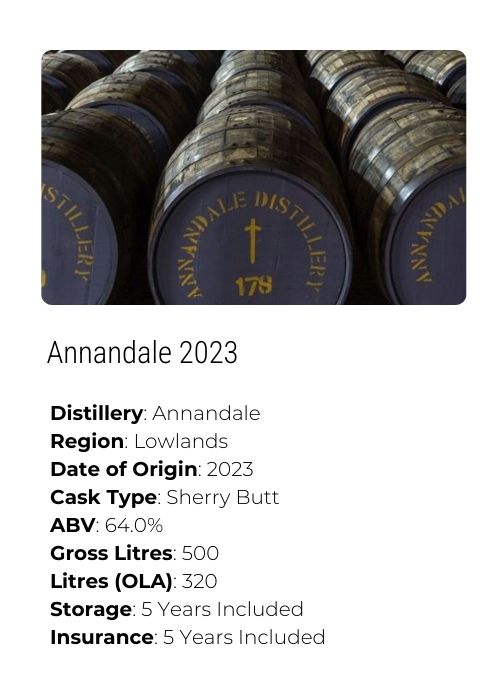

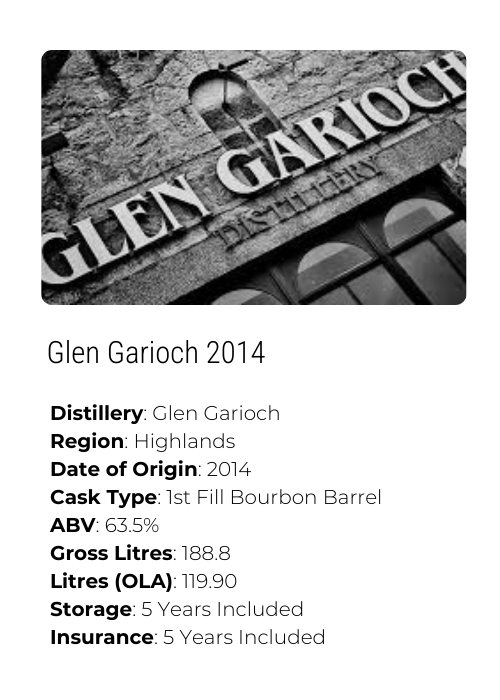

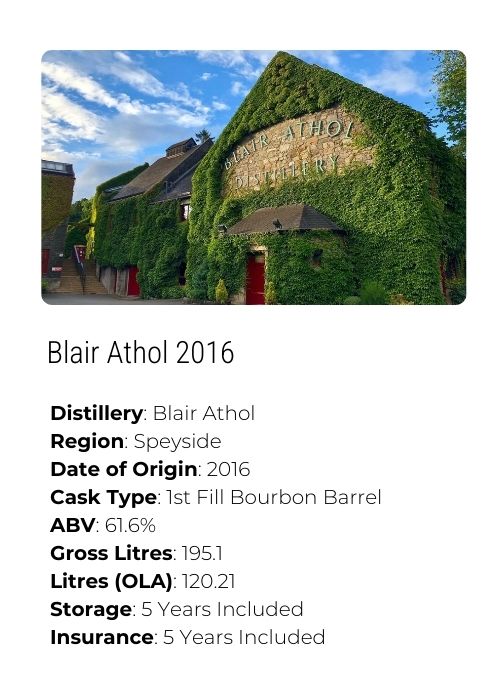

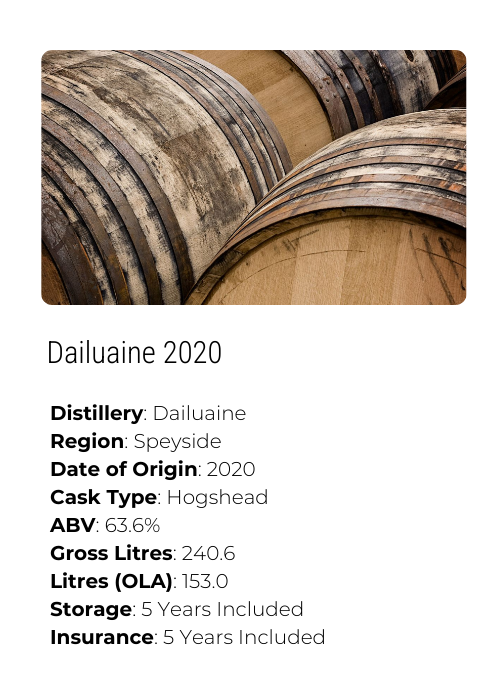

Speyside Capital can connect you to rare and exclusive casks that are typically hard to access:

How to ensure you're purchasing high quality casks.

Hear from our Technical Director of Whisky Assets, Ian Evans.

Historically, whisky can garner between 8-15% annual returns on your portfolio.

Projected £25,000 Portfolio Value

No Data Found

No Data Found

Discover Balanced Portfolio's

£100,000 Portfolio Example

4 x Bunnahabhain 2024 2 x Royal Brackla 2011 1 x Bruichladdich 2008- 6 x Ardmore 2023 1 x Dalmore 2015 Total: 14 Casks

No Data Found

£75,000 Portfolio Example

4 x Auchentoshan 2024 1 x Aberlour 2015 1 x Bunnahabhain 2019 1 x Laphroaig 2012- 1 x Benriach 2014 1 x Royal Brackla 2024 - Total: 9 Casks

No Data Found

£50,000 Portfolio Example

4 x Auchentoshan 2024 1 x Deanston 2023 3 x Tomatin 2021 2 x Royal Brackla 2015- - - - Total: 10 Casks

No Data Found

£25,000 Portfolio Example

3 x Ardmore 2024 1 x Bunnahabhain 2020 1 x Royal Brackla 2015- - - - Total: 5 Casks

No Data Found

Get Started

With our full turnkey service, we take care of everything, from cask to profit.

Stage 1

Cask Acquisition & Portfolio Creation

Our dedicated team of experts manage distillery relationships to unlock the purchase of rare and exclusive Scotch whisky casks, creating a bespoke portfolio you can be proud of.

Stage 2

Compliance, Regulation, Storage and Insurance

We handle the strict compliance and regulation procedures surrounding your whisky, ensuring your casks are stored in optimal conditions within our government bonded warehouses throughout Scotland. Five years of storage and insurance are automatically included within your purchase.

Stage 3

Quality Assurance, Cask Management and Exit

Our dedicated team are the custodians of your assets during the holding period. Regular warehouse visits allow us to monitor the environment and casks, ensuring your whisky is maturing perfectly. When the time is right, whether you want to sell on for profit or bottle your very own whisky, we’ll support you.

The time is now

What makes Scotch whisky such a unique opportunity in 2025?

Hear from our Chairman, Manoj Karkhanis.

Take control and monitor your whisky portfolio with our leading client portal, mySpeyside.

Monitor and expand your assets from anywhere in the world.

FAQ's

The minimum purchase and smallest portfolio offered with Speyside Capital is a value of 25,000 GBP. This allows us to create a balanced and varied selection of casks, based on your goals, preferences, budget and risk tolerance, to maximise potential returns. Of course, there’s also scope to acquire specific whisky brands you would like included within your portfolio, too.

We have a dedicated compliance manager who ensures all regulations and procedures are closely followed to ensure complete safety of your portfolio. This includes but is not limited to procedures and regulations relative to HMRC, WOWGR, European Movement Control System and Spirit and Drink Verification Scheme.

We store your casks in our fully regulated government-bonded warehouses throughout Scotland, no further than two hours from our headquarters. These are regularly checked by our expert team and are required to meet strict regulations that ensure the quality of the whisky within your casks remains as high as possible.

No, we include 5 years storage and insurance with your purchase.

We recommend a minimum of 3 years, to allow your casks to mature and deepen in flavour, ensuring higher value to bottle or resell when the time is right. Our team can carefully curate casks portfolios that are purposefully built for a 3-5 year investment.

Your dedicated advisor will work directly with our experienced portfolio managers to build you a unique whisky cask portfolio that combines various brands, ages and types of casks. After onboarding through official paperwork and identification, we then ensure the casks within your portfolio are placed in your name. We offer a turn-key solution for you, taking care of every step of the process to make your experience as seamless as possible.

Sell your casks on for profit or bottle for your own enjoyment. There are multiple exit strategies available to you, which we can discuss with you when you reach out to us.

Our main office is located in Glasgow, Scotland, allowing us to leverage our roots and maintain strong distillery relationships. We also have offices in Singapore and India.

Discover Your Options

Contact us today to learn more about your options, opportunities and get all your questions answered.